US Tariffs Cloud ASML's Order Outlook: Navigating Uncertain Waters

The semiconductor industry, a cornerstone of modern technology, is facing a period of significant uncertainty. A key player, ASML Holding NV (ASML), the world's leading supplier of lithography systems crucial for chip manufacturing, finds its order outlook clouded by the ongoing impact of US tariffs. This article delves into the complexities of this situation, exploring the implications for ASML, its customers, and the broader technological landscape.

Understanding the Impact of US Tariffs

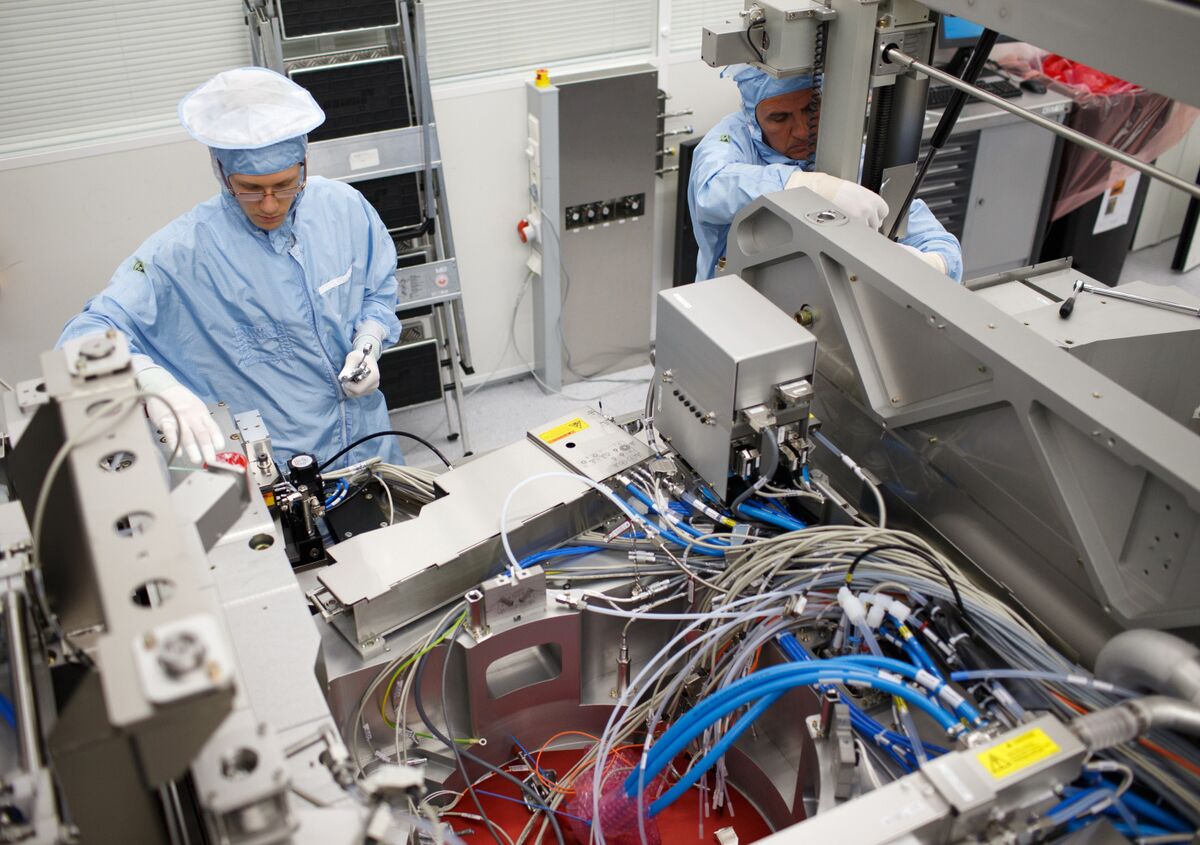

ASML's highly sophisticated lithography systems are essential for producing advanced semiconductors. These machines, particularly the EUV (extreme ultraviolet) lithography systems, are incredibly expensive and complex, with a single unit costing hundreds of millions of dollars. The US government's imposition of tariffs on various goods, including components used in these systems, has directly impacted ASML's supply chain and, consequently, its ability to meet demand.

Increased Production Costs

The tariffs translate directly into higher production costs for ASML. This increased expense is not simply absorbed; it inevitably affects the final price of its machines, making them less affordable for chip manufacturers. This price increase can impact purchasing decisions, potentially leading to reduced orders.

Supply Chain Disruptions

The tariffs have created significant complexities in ASML's supply chain. Procuring components from various global suppliers becomes more challenging and costly due to tariffs and associated bureaucratic hurdles. This can lead to delays in production and potentially affect ASML's ability to meet delivery deadlines, further impacting customer relationships and potentially future orders.

ASML's Strategic Response and Future Outlook

ASML, despite facing these headwinds, is not a passive player. The company is actively working to mitigate the effects of the tariffs. This includes:

- Diversification of Suppliers: ASML is likely exploring alternative suppliers to reduce its reliance on tariff-affected sources. This strategy, however, takes time and may involve compromises in terms of quality or cost.

- Negotiations and Lobbying: The company is actively engaging with relevant authorities to advocate for tariff reductions or exemptions. This involves intense lobbying efforts to influence policy decisions.

- Price Adjustments and Customer Negotiations: ASML is likely navigating complex price negotiations with its customers, attempting to balance the increased costs with maintaining a competitive edge.

The future outlook for ASML remains somewhat uncertain. The persistence of the tariffs, their potential escalation, and the overall economic climate will significantly impact its order flow. While ASML's technological leadership and strong customer relationships provide a degree of resilience, the external factors remain a considerable challenge.

Broader Implications for the Semiconductor Industry

The challenges faced by ASML are not isolated. The impact of US tariffs ripples through the entire semiconductor ecosystem. Increased costs for chip manufacturing can affect the price of electronics and ultimately impact consumers. Furthermore, this situation highlights the complexities of global supply chains and the vulnerabilities they present in a politically charged environment.

Geopolitical Considerations

The situation underscores the geopolitical dimension of the semiconductor industry. The US's trade policies have significant global consequences, affecting not just ASML but also the competitiveness of various nations in the technology sector. This highlights the need for greater transparency and predictability in international trade regulations to ensure a stable and sustainable environment for innovation.

Conclusion: Navigating Uncertainty

ASML's experience with US tariffs serves as a case study of the challenges facing global businesses operating in a complex geopolitical landscape. While the company's technological prowess and strategic responses offer some resilience, the uncertainty surrounding tariffs continues to cloud its order outlook. The situation necessitates a careful consideration of the broader implications for the semiconductor industry and the global economy as a whole. The coming months will be crucial in determining how ASML and the wider semiconductor sector navigate these uncertain waters.