China's Export Surge: A Pre-Tariff Trade Rush?

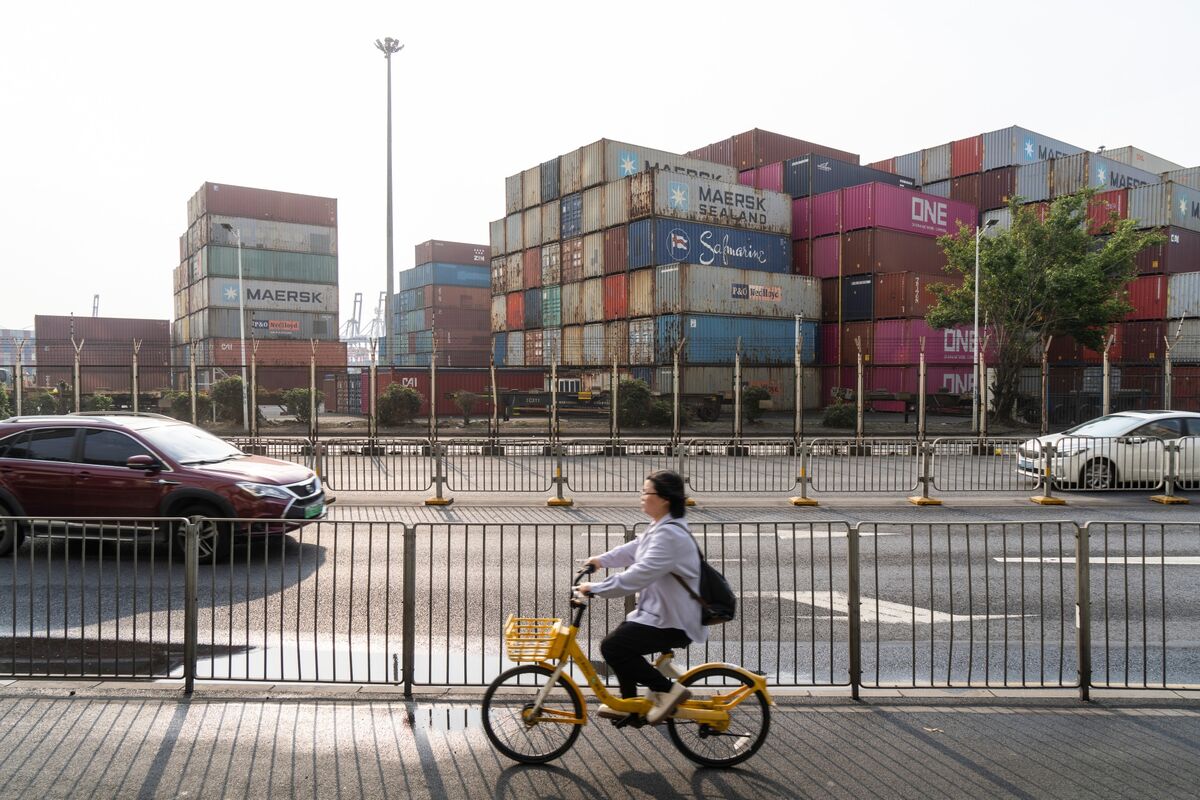

China's exports experienced a remarkable surge in the months leading up to the implementation of new tariffs by the United States and other countries. This unexpected jump sparked significant debate, with analysts scrambling to understand the underlying causes. Was it a genuine reflection of economic strength, or a strategic preemptive maneuver driven by the looming trade war? This article delves into the complexities of this export surge, exploring various contributing factors and offering a comprehensive analysis.

Understanding the Phenomenon: A Closer Look at the Numbers

The data speaks volumes. China's exports saw a dramatic increase in the period before tariff implementation, defying predictions of a slowdown. While precise figures fluctuate depending on the source and reporting period, the trend is undeniable. This surge was not evenly distributed across all sectors; certain industries witnessed exponentially higher growth than others. This uneven distribution suggests a nuanced situation rather than a simple, overarching cause.

Key Contributing Factors:

-

Preemptive Stockpiling: This is arguably the most significant factor. Businesses, both domestic and international, anticipated higher tariffs and sought to circumvent them by importing goods before the price hikes took effect. This resulted in a temporary inflation of export numbers, masking underlying economic realities. Think of it like a last-minute shopping spree before a price increase – a rush to beat the clock.

-

Weakening Yuan: The devaluation of the Chinese Yuan against major currencies, particularly the US dollar, made Chinese goods relatively cheaper in the international market. This enhanced their competitiveness and boosted demand, further contributing to the export surge. This created a short-term advantage for Chinese exporters.

-

Strong Domestic Demand (Initially): While the trade war eventually dampened domestic Chinese demand, in the initial stages, there was a period of relatively strong domestic consumption, which indirectly fueled the export sector through increased production. This effect, however, was likely overshadowed by the preemptive stockpiling.

-

Shifting Global Supply Chains: Some companies, anticipating disruptions to supply chains due to the trade war, rushed to secure goods from China before the tariffs made sourcing elsewhere more attractive. This added to the temporary spike in exports.

Separating the Signal from the Noise: Analyzing the Sustainability of the Surge

The key question remains: was this export surge a genuine indicator of long-term economic strength, or merely a temporary, artificial inflation driven by the looming trade war? The evidence strongly suggests the latter. The surge was unsustainable; post-tariff implementation, export growth has significantly slowed or even reversed in some sectors.

Long-term Implications:

The pre-tariff export surge highlights the profound impact of trade policy on global commerce. It demonstrates the power of anticipation and strategic stockpiling in distorting short-term economic indicators. While it provided a temporary boost to China's economy, the long-term implications of the trade war, including supply chain disruptions and decreased global trade, are likely to be more significant and negative.

Looking Ahead: Navigating Uncertain Trade Landscapes

The Chinese export surge serves as a crucial case study in the complexities of international trade and the ripple effects of trade policy. Predicting future trends remains challenging, given the ongoing volatility in global trade relations. However, understanding the factors that drove this particular surge offers valuable insights for businesses and policymakers alike.

Tips for Businesses Navigating Trade Uncertainty:

- Diversify Supply Chains: Reducing reliance on a single source country mitigates risk.

- Strategic Forecasting: Accurately predicting policy shifts and their impact is crucial.

- Agility and Adaptability: Businesses must be able to swiftly adjust strategies in response to changing circumstances.

The pre-tariff export rush from China serves as a potent reminder of how short-term market manipulations can obscure underlying economic trends. While the numbers initially appeared impressive, a deeper analysis reveals a more nuanced and ultimately less optimistic picture of the long-term implications of the trade war. The experience emphasizes the importance of critical analysis and careful interpretation of economic data in the face of significant geopolitical events.