ASML Misses Estimates Amid US Tariff Fears: A Deep Dive into the Semiconductor Giant's Challenges

ASML Holding NV, the world's leading supplier of lithography systems crucial for chip manufacturing, recently reported weaker-than-expected quarterly results, sending shockwaves through the semiconductor industry. This underperformance wasn't solely due to market fluctuations; it's intricately linked to growing concerns surrounding US tariffs and their impact on global trade. This analysis delves into the reasons behind ASML's missed estimates, exploring the complexities of the current geopolitical landscape and its implications for the future of chip production.

Understanding ASML's Role in Semiconductor Manufacturing

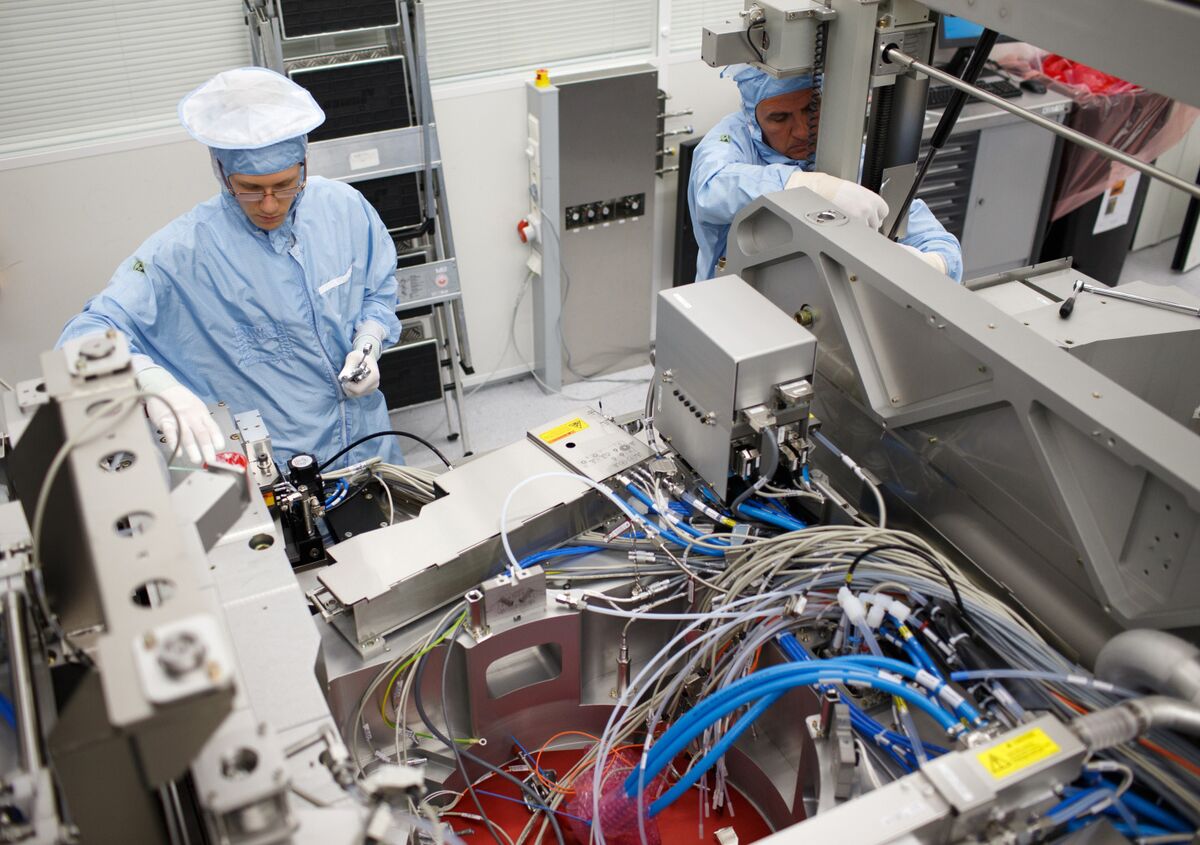

Before dissecting the reasons behind ASML's recent performance, it's crucial to understand the company's pivotal role. ASML's lithography machines are essential for creating the intricate patterns on silicon wafers, forming the basis of modern microchips. These machines are incredibly sophisticated and expensive, making ASML a near-monopoly in the high-end segment of the market. Any disruption to ASML's operations has significant ripple effects throughout the semiconductor supply chain.

The Impact of US Tariffs on ASML's Performance

The primary driver behind ASML's missed estimates is the escalating uncertainty surrounding US tariffs. While not directly impacting ASML's sales to its major customers, the tariffs significantly affect the overall market demand for semiconductors. Increased costs associated with imported components and the resulting higher prices for finished goods can dampen consumer demand and lead to reduced orders from chip manufacturers, directly affecting ASML's sales.

The knock-on effect is substantial: Reduced orders from chip manufacturers translate into lower demand for ASML's sophisticated and expensive lithography systems. This slowdown in orders is a significant contributor to the company's recent performance shortfall.

Beyond Tariffs: Other Contributing Factors to ASML's Underperformance

While US tariffs play a dominant role, it's not the sole factor impacting ASML's results. Other contributing elements include:

- Global Economic Slowdown: The global economic climate is undeniably impacting consumer spending and investment, leading to a decrease in demand for electronics and, consequently, semiconductors. This broader economic uncertainty contributes to the reduced orders ASML is experiencing.

- Inventory Adjustments: Chip manufacturers are adjusting their inventory levels in response to the slower market demand. This means they're ordering fewer machines in the short term, further impacting ASML's sales figures.

- Geopolitical Instability: The ongoing geopolitical tensions and uncertainties add another layer of complexity to the semiconductor market. These factors contribute to the overall cautious approach taken by many chip manufacturers in their investment strategies.

Looking Ahead: Navigating the Challenges and Opportunities

ASML's recent underperformance doesn't necessarily signal a long-term decline. The company remains a dominant player in a critical industry. However, navigating the current challenges requires a strategic approach:

- Diversification of Customer Base: Reducing reliance on specific regions or customers can mitigate the impact of future disruptions.

- Technological Innovation: Continuing to push the boundaries of lithography technology will ensure ASML maintains its competitive edge and attracts new customers.

- Stronger Supply Chain Relationships: Fortifying relationships with key suppliers can help manage the risks associated with global supply chain disruptions.

Conclusion: A Temporary Setback or a Sign of Deeper Issues?

ASML's missed estimates are a cause for concern but not necessarily a harbinger of long-term failure. The confluence of US tariff fears, global economic slowdown, and inventory adjustments created a perfect storm impacting the company's recent performance. However, ASML's strong market position, technological prowess, and potential for strategic adaptation suggest the company is well-positioned to weather this storm and emerge stronger. The coming quarters will be crucial in determining whether this is a temporary setback or a sign of deeper, more structural challenges within the broader semiconductor industry. The ongoing interplay between geopolitical factors, economic conditions, and technological innovation will ultimately determine ASML's trajectory in the years to come.